Google wasn’t the first search engine, FB was not the first social network, Alibaba faced stiff competition from both domestic & international players, Southwest and Netflix were written off by competitors multiple times……………. It is safe to conclude that the evolution of every valuable company has been through brutal competition which then begets the question – What did these companies do to survive competition, from both large incumbents and potential new entrants, to create such tremendous shareholder value? And more importantly, what can the startup CEO learn from the same as they embark on their competitive battles? The purpose of this blog is to provide the startup CEO with a framework that captures learnings from successful competitive battles. I believe this framework should (1) Help entrepreneurs shape their business model such that it enjoys impenetrable competitive advantage or a large barrier to imitation (2) Encourage entrepreneurs to alter capital and resource allocation to feed and widen the barrier to imitation (yes they need to be fed and protected – more on that below) (3) Help better communicate the same to their employees and investors as they align on a business strategy (4) Avoid ‘Grow or Die’ mindset which leads to ‘Grow and Die’ results

The framework is best appreciated in action through examples which we will come to, but before that its important to understand the 3 key tenets of the framework –

(1) Tenet 1 – Shape the business model such that the barrier to imitation grows as the company grows. The business model needs to enjoy one of the two – Economies of scale coupled with consumer switching costs or Network effects.

a. Economies of scale coupled with consumer switching costs –

i. The commercial airframe industry, microprocessors, beer and software industry have large market leaders while shoe production and packaging manufacturing are highly fragmented. What explains the difference in market structure? – Economies of scale! – if there are large economies of scale then market is concentrated and players become large and create value and if not, market is fragmented with no one player capturing value.

ii. Economies of scale are prevalent when there are significant fixed costs in the business and hence, the average cost per unit declines rapidly with scale – which implies that the larger player will always have a lower cost per unit. If a new player enters the incumbent can cut price (or out advertise) and still be profitable (by virtue of lower cost) while the new player suffers heavy losses.

iii. Economies of scale standalone doesn’t always go the distance as an aggressive competitor will fight if it believes the consumer will switch. Some amount of consumer switching cost is necessary – even rather small amounts of consumer switching cost works as the incumbent will always have a cost advantage over a sub scale new entrant and hence, can offer better terms to the consumer to not switch!

iv. Economies of scale need to be fed and protected – Any attempt by competitors to imitate needs to be responded with aggression and speed – this ensures that the competitor does not achieve the scale required to match the leader’s cost structure. Alibaba vs Ebay, Uber vs Lyft are classic examples of how these companies fought tooth and nail to not allow the new entrant to garner scale. I have been part of a company’s board wherein the board committed the cardinal sin of under-feeding this moat and hence, losing out to a competitor who understood the importance of growing and protecting the same – consequently, we had to sell out cheap!

v. NETFLIX’s masterful business move to buyout rights to content making it exclusive and invest in original content raised the overall fixed costs in the industry making it very hard for new entrants to survive. Prior to this, content was available for all streaming players on a pay per view basis.

vi. IKEA is a great example of how it has exploited economies of scale to feed consumer switching costs – the company enjoys significant economies of scale in procurement, logistics, distribution, R&D, consumer acquisition which is then passed onto the consumer in the form of cheaper products which feeds consumer switching costs – to make products cheaper while maintaining quality has been a key management KPI for the company.

b. Network effects – network effect are well understood and I talk in depth about it here Measuring Network Effects – implications on strategy and business model (linkedin.com)

(2) Tenet 2 – Shape the business model to avoid any direct confrontation with large incumbents. This can be done in the following 2 ways –

a. Develop a business model such that any attempt to imitate by a large incumbent would severely damage its existing business, also known an ‘C’ounter-positioning –

i. I am personally in love with this moat as it works near perfectly every time (the book ‘7 Powers’ by Hamilton Helmer does a fantastic job of explaining the same). The premise is simple – a startup is said to be counter-positioned relative to a large incumbent, if the large incumbent faces imminent losses to its current business if it imitates the startup’s business model.

ii. In such a case, large incumbents don’t tend to react or react late enough such that the new entrant has the time to reach the desired economies of scale and consumer switching costs / Network effects.

iii. Contemporary example of the same playing out is the food delivery companies (DoorDash, Deliveroo etc.) vs the online food ordering platforms (JustEat, GrubHub etc.) – the online food ordering platforms were reluctant to enter the food delivery market for the longest time not because they didn’t understand logistics but couldn’t fathom the losses in their highly profitable existing business! This delay allowed the food delivery companies to achieve economies of scale required to fight if they were to react.

b. Develop a business model to cater to an untapped segment and is unattractive for the large incumbent to chase or New Market ‘D’isruption –

i. The consumer segment is previously not catered by the large incumbent – any share garnered by the startup does not impact the financial performance of the large incumbent.

ii. It’s an unattractive consumer segment with regards to lower gross margins (%) – the managers at large organizations protect GM (%) doggedly and tend to flee and not attack when a startup caters to an lower GM (%) business

iii. In such a case, large incumbents don’t tend to react or react late enough such that the new entrant has the time to reach the desired economies of scale and consumer switching costs / Network effects.

iv. Southwest airline is a classic example wherein the company targeted consumers who would historically, choose ground transport. Also, the company’s value chain was highly distinctive with its point-to-point operating model vs hub & spoke for other airlines, choice of airports, fleet of aircrafts, gate operations etc. – differences in every activity performed made it very hard for the incumbent to copy Southwest’s model without compromising their existing model and business.

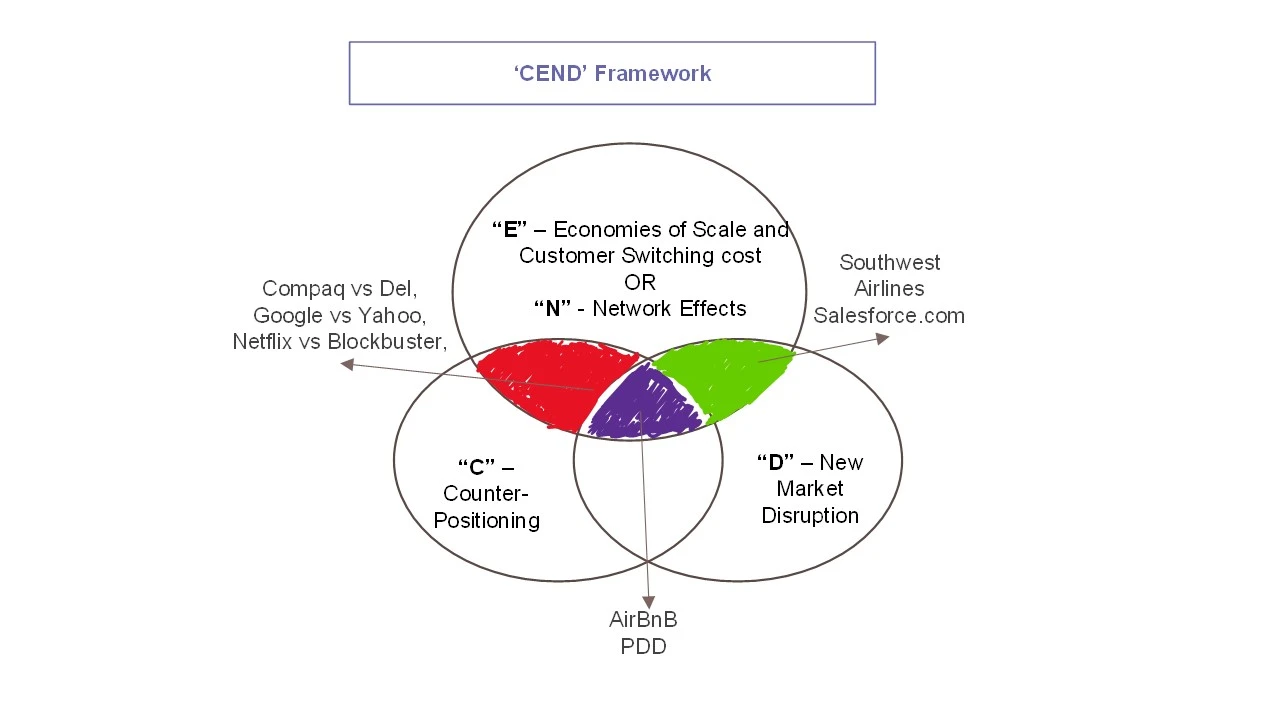

(3) Tenet 3 – Magic happens at the intersection of Tenet 1 and Tenet 2 which brings me to the ‘CEND’ framework

a. Red Moat – ‘E’conomies of scale & consumer switching costs coupled with ‘C’ounter-positioning – exploited by Compaq vs Dell, Netflix vs Blockbuster, Google vs Yahoo, Food delivery vs Online food ordering

· Google vs Yahoo – Yahoo was a directory model wherein online search results were human-assisted – humans could curate most popular websites. Also, Yahoo monetized these search results. Google search was algorithm based and hence, enjoyed better consumer experience and ‘economies of scale’. By the time Yahoo realized its mistake it would have to completely abandon its revenue from search – which further delayed their reaction to Google. And all this while Google got the time to scale to exploit strong network effects.

· Compaq vs Dell – Dell’s direct to consumer strategy vs Compaq’s distributor led model allowed Dell to offer latest and custom computer configuration at a lower price point vis a vis Compaq. Compaq found it very hard to react given that going direct to consumer would have damaged its existing relationship and business with distributors.

· Netflix vs Blockbuster – Netflix’s subscription model was counter-positioned to Blockbuster’s late fees led revenue model. Any changes to the revenue model would have significantly damaged the then public Blockbuster’s P&L – Blockbuster did react but it was too late as Netflix had achieved significant economies of scale and consumer switching costs.

b. Green Moat – ‘E’conomies of scale & consumer switching costs coupled with New Market ‘D’isruption – exploited Southwest, Salesforce.com

· Both these companies targeted an untapped and unattractive segment for their respective incumbents – ground transport users for Southwest airlines and SMBs for Salesforce.com. And hence, the large incumbents did not care till these companies had become large (with significant economies of scale) and started to attack the core market of the incumbents.

c. Purple Moat – is at the intersection of all 3 explains the rise of AirBnB, PinDuoDuo

· AirBnB – OTAs witnessed the rise of AirBnB but took longer to react because any change in business model would have severely damaged the long standing relationship with hotels while Airbnb’s lower price point enabled a new set of consumers to travel. AirBnB scaled and as a marketplace business model has amongst the strongest network effects.

· PinDuoDuo – targeted an under-served consumer in smaller cities in China while it was counter-positioned to the large incumbent e-commerce players (who make money from large brands) while PDD focused on the small manufacturers/un-branded sellers. The leading players were late to react and PDD now has the economies of scale and resources to fight.

To Summarize –

1. Shape the business model such that you have an economic advantage over sub-scale new entrants while the large incumbents are paralyzed to react!

2. Magic happens when the business model achieves both these objectives without sacrificing strong consumer value proposition and product market fit – (https://www.linkedin.com/pulse/measuring-product-market-fit-your-startup-curwing-right-raghav-bahl)

3. Align capital and resource allocation to widen the moat – moats need feeding and protection before they can provide cover for a very long time.

4. Entrepreneurs reaching out to us, please do mention the moat colour in the email

5. Everything starts from nothing!