Over the last 6 months, my conversations with entrepreneurs, leading fast-growing startups, have had a particularly common thread – the response to my question “What is your competitive advantage and is it sustainable?” (asked simply “what is different about your company and how easy/difficult is to imitate the same?”) – has been readily relegated to “Look at my topline growth” (accompanied with a facial expression which mostly says “Don’t you already see it?”!) or “I am the category leader” or “I am going to be operationally positive in the next 6 months and then raise more capital”. This makes me wonder if, given the times we operate in, the thought process of these super-smart entrepreneurs is being blurred to think that hyper-growth drives sustainable competitive advantage (or even worse, as long as there is fast growth thinking about sustainable competitive advantage is meaningless!)

I am going to stay away from harping about the benefits of a sustainable competitive advantage – but track the shareholder value creation of Alibaba, Google, Facebook, Amazon. All these companies battled heavy competition not by chasing hyper-growth (or having the deepest pockets fund them!) but executing a clear strategy with the aim of building sustainable competitive advantage – ‘growth’ happened to follow (and has remained committed to them!) The purpose of this blog is multi-fold (1) At the cost of repetition, revisit core tenets of a good strategy which drives a company towards gaining a sustainable competitive advantage (2) Provide a simple framework to better communicate the same (3) Identify key pitfalls that keep entrepreneurs away from investing behind sustainable competitive advantage which I sometimes refer to as ‘The Deception of Growth’.

The core tenets of a sustainable competitive advantage lie in two key things (1) ‘Tradeoffs’ and (2) Making imitation difficult for competitors

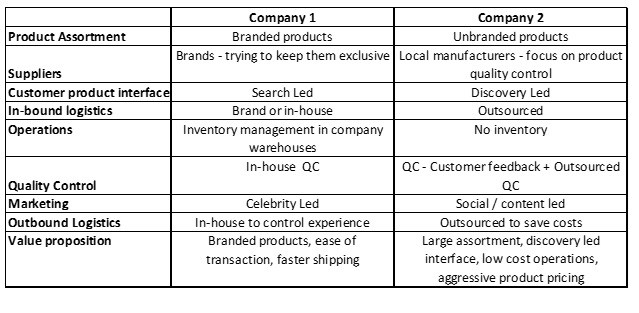

As you see above, both these companies have ‘chosen’ by way of internal policy to conduct activities differently in order to fulfill customer needs. This brings two things to the forefront (1) ‘Tradeoffs’ allow companies to provide a unique value proposition to their customers (2) ‘Tradeoffs’ or these ‘hard choices’ are incompatible with each other and hence, failure to make a choice would end up in disaster – if ‘Company 2’ ended up using in-house logistics it will never make money while ‘Company 1’ would lose customers if they outsourced the delivery function. Not making ‘hard choices’ would result in poor customer experience (read ‘high churn’), poor unit economics (read ‘high costs’) and confusing employees (read ‘broken organization structure’), investors and finally, result in no competitive advantage (read ‘slow death’).

2. Making imitation difficult for competitors – obstacles to imitation by potential/existing competitors are never insurmountable, having said that, it is important for a company to present its competitors with a rapidly moving target. There are 2 ways to do this (easier said than done!) (a) Make ‘Tradeoffs’ incompatible for as many activities as possible, ‘more the merrier’ – which means that competition needs to copy entire set of activities rather than just one or two activities to compete with you (b) Improve activity performance with every transaction – if the performance efficiency of all your activities improves with every transaction, you have a moving target for your competition! – I have not seen many cases wherein an incumbent competitor has fully given up its existing set of activities to chase new set of activities or for that matter catch up with the player who has already set a lead in setting up new processes, systems, best practices and manage costs.

Communicating your company’s competitive advantage –

Why do entrepreneurs fail to adopt a coherent strategy?

Key Takeaways –