Learning from Failure (Part 1) – ‘Growing without Product-Market

Fit’

“Failure is life’s best teacher” – while a lot has been shared about

the reasons for startup success, but to my surprise, not a lot has

been shared about the reasons for failure. I believe the ‘mistakes’

of the past can be a treasure for a budding entrepreneur. Also, I,

as an investor, have been most valuable (or so I believe!) to

entrepreneurs while sharing failed initiatives/strategies or

thoughts on ‘What NOT to do?’ rather than ‘What to do’? – While no

two startup paths are alike, I have found that smart entrepreneurs

extract relevant learning and course correct.

In the spirit of making some of the ‘mistakes’ well-known, I expect

to capture through the ‘Learning from Failure’ series some of the

obvious ‘mistakes’ – ‘Growing without Product-Market fit’ (part 1),

‘The Inconsistent Value Chain’ (part 2 coming soon), ‘Capital

allocation – invest behind growing the Moat’ etc – while far from

comprehensive, the aim here is to create a valuable repository of

startup mistakes.

The following is a story of a B2C marketplace business that was in

‘hyper growth’ mode till it flew off a cliff. The company was

founded by a stellar team that came from some of the leading global

internet companies and was backed by marquee venture capital funds.

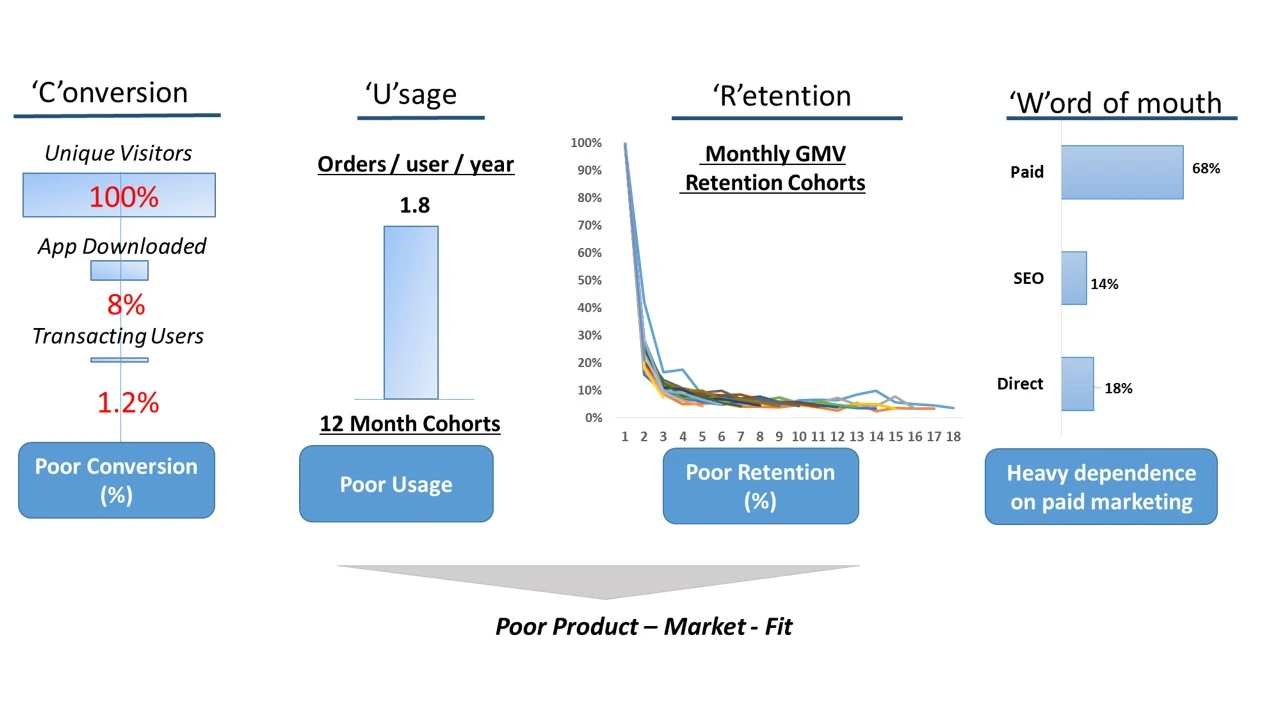

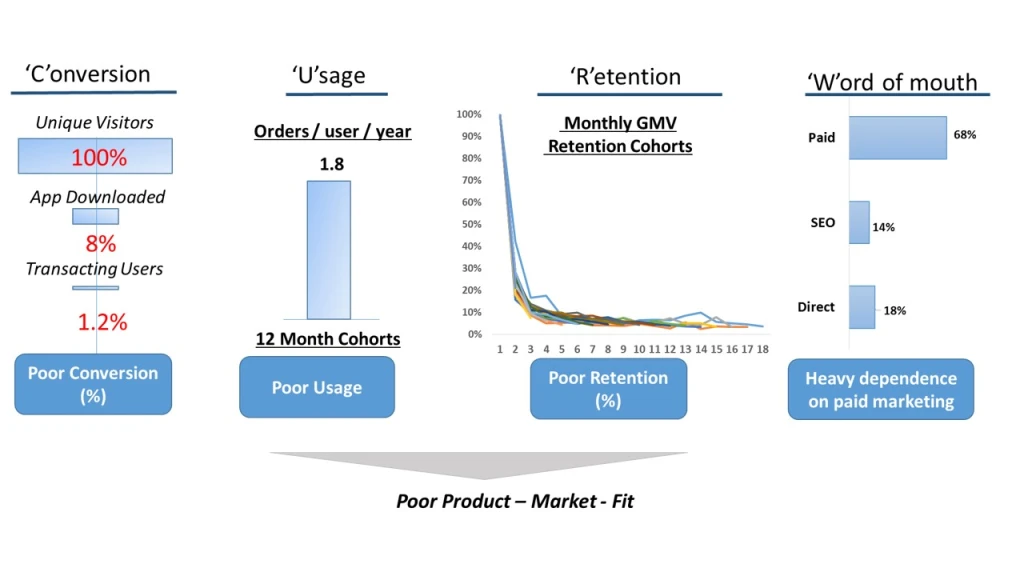

Following are the four key metrics – I often call it the ‘CURW’

(pronounced at CURVE) framework- the acronym is born out of the

first letter of each of the four metrics. (While evaluating the

‘product – market fit’ for a company, I often question if the

company is ‘CURW’ing in the right direction?)

Growing at Breakneck Speed…..

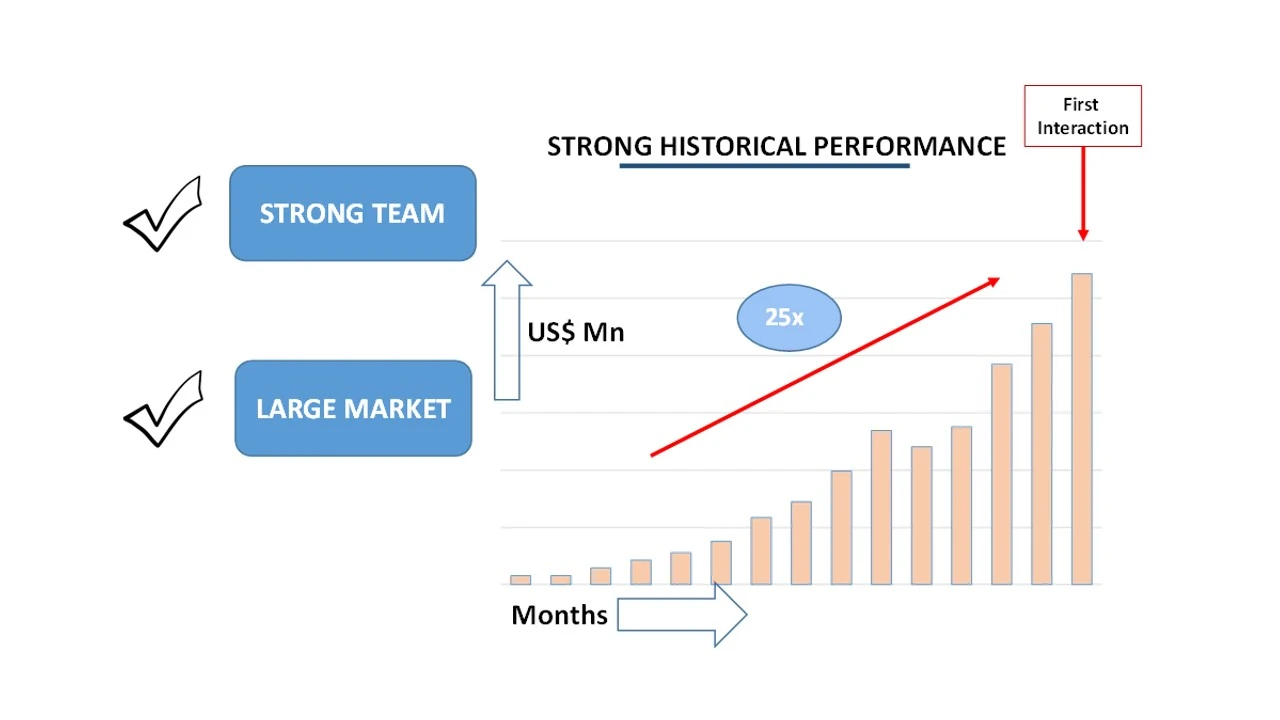

My first meeting with the entrepreneur had me salivating! – the

market opportunity was large and under-penetrated, the founding team

had developed a solid product, developed a strong fund raising pitch

and most impressively GMV growth was off the charts – to the extent

that, I had not witnessed such growth before! The company had grown

25x over the last 12 months to a multi-million dollar GMV run rate.

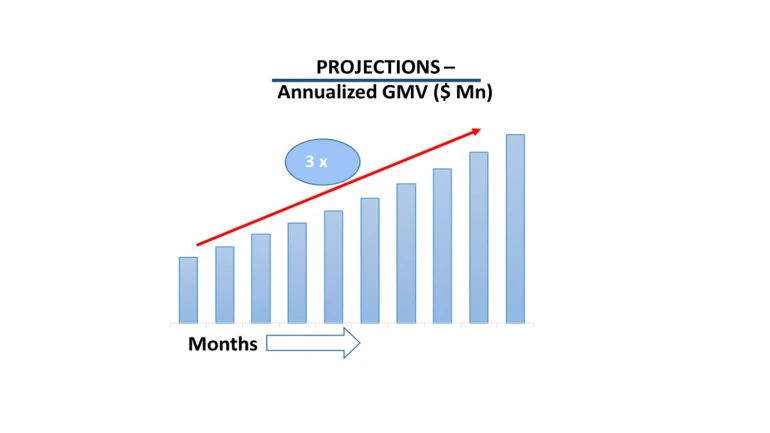

The projections were equally aggressive and if historical

performance was any judge of future performance, the company was

well on its path to beat projections.

Double clicking on the quality Product-Market-Fit

While the growth looked exciting, I ended up double clicking on

strength of the product-market fit using the ‘CURW’ framework (More

about the framework here –

https://thenetwortheffect.com/2018/02/19/measuring-product-market-fit-is-your-startup-curwing-in-the-right-direction/)

-

Conversion (%) and Conversion (%) trend

- poor conversion (%) and more importantly, reducing conversion(%)

trend was worrying – it implied that the company was heavily

dependent on growing traffic to keep the growth engine firing and

also, the ‘funnel leakage’ meant lack of consumer trust on the

platform. In order to keep Consumer Acquisition Co (CAC)st low the

company needed to significantly grow organic traffic to the

platform.

-

Usage

- the usage on the platform was low at 1.8x transactions per

customer per year. For a low AoV product and frequent use case in

the offline world, this number was a concern.

-

Retention

- customers were not sticky and the platform was heavily dependent

on new customers to keep growth humming.

-

Word of Mouth

- share of paid customer acquisition was high. Any change in

competitive spending would have spiked consumer acquisition cost –

at low conversion (%) a small increase in cost of traffic can

cause a huge spike in consumer acquisition cost.

Poor ‘Product-Market-Fit’ So what?

Following are some of the answers I hear in response to a poor PMF –

-

How does it matter?

- Product Market Fit is a reflection of two important things (a)

Measures customer love – how badly does customers want the product

and advocate your product to others? (b) Capital Efficiency –

early reflection of how the Unit Economics of the business are

going to shape up. In the above case, low conversion rate(%),

heavy dependence on paid marketing, low retention (high churn) and

poor usage metrics point towards a long CAC payback period and low

Customer Life Time Value (CLTV). A long CAC payback period implies

high cash burn while low CLTV/CAC ratio means poor profitability!

-

We are market leaders

- being the market leader for the sake of it has little meaning!

(apart from bragging rights) Key question is the impact of

category leadership on customer switching & acquisition cost and

the company cost structure? – With no switching costs coupled with

little economies of scale, category leadership had no real benefit

for the platform.

-

We can alter ‘PMF at scale’

- chasing PMF at scale is excruciatingly difficult and painful.

The number of battles an entrepreneur can fight at any point of

time is limited but with pushing out proving ‘PMF at scale’

approach results in a multi-enemy war – high cash burn, reduce

growth targets to cut burn, harder to raise capital, potential

down rounds, finding it difficult to hire/retain high quality

talent, customer churn at scale making growth even harder,

competition with better PMF raises capital! In my limited

experience, this has been extremely hard to solve for and a big

reason for the same is the following point. High valuation adds

‘fuel to the fire’ – ‘a large capital raise at a steep valuation’

is just what the doctor ordered at this point or maybe not! The

large fund raise can hide all challenges with regards to the poor

PMF and can help the entrepreneur continue to chase lofty growth

targets – this is further pushed by the incoming investor who just

invested with continued expectations of high growth. At this

point, the entrepreneur finds it extremely tough to change course

– the focus has now changed from solving the customer problem to

chasing the next fund raise!

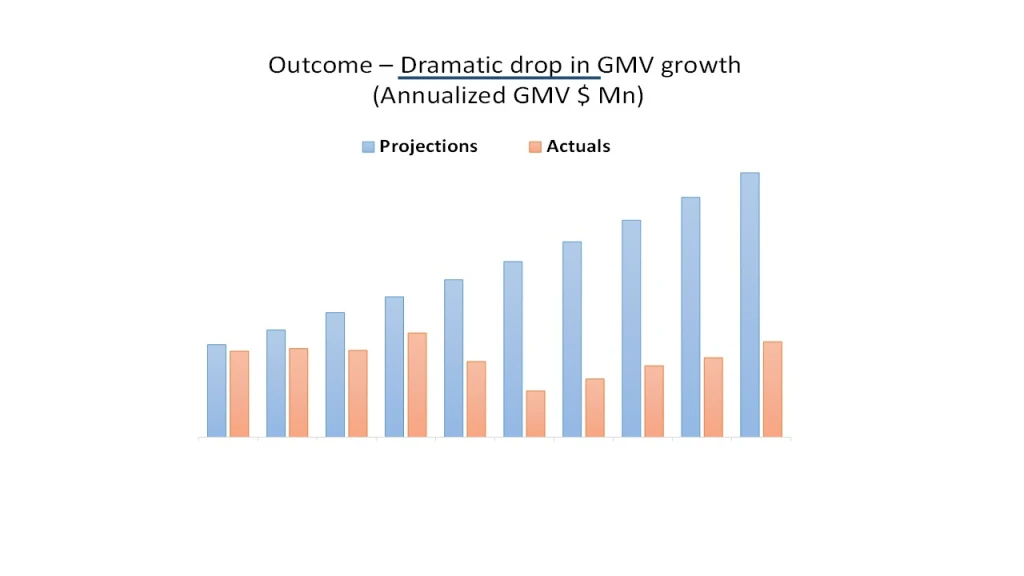

Outcome

To complete the story, the company soon found it very difficult to

sustain high growth given the high cash burn and fleeing customers.

New and existing investors found it very difficult to support the

company beyond a point. The entrepreneur cut growth to increase life

and eventually sold the company for less than cash invested.

To Summarize -

- Rapid Growth Does Not Equal To Product Market Fit

-

Focus on defining, tracking and improving key metrics that prove

strong product-market fit

- Solving for PMF at scale is 100x more difficult

-

Market Leadership for the sake of it has little or no meaning –

does leadership impact customer switching cost or reduce operating

cost?

-

If your ‘CURW’ metrics are strong, please do give me a shout!

- Everything starts from nothing!